Income protection is sometimes mixed up with payment protection insurance, and we have all heard of the PPI mis-selling scandal. Essentially PPI was being added to loan and credit cards with the lenders sometimes hinting that the finance approval actually hinged on the insurance, with many companies targeting their employees on how much was sold without any consideration of whether it was suitable or not… Little wonder then that the regulator took a blanket approach to PPI and most sales were reimbursed to the client– Many of these clients may have been self-employed, part time, house person etc. and would never have been able to claim.

Income protection is sometimes mixed up with payment protection insurance, and we have all heard of the PPI mis-selling scandal. Essentially PPI was being added to loan and credit cards with the lenders sometimes hinting that the finance approval actually hinged on the insurance, with many companies targeting their employees on how much was sold without any consideration of whether it was suitable or not… Little wonder then that the regulator took a blanket approach to PPI and most sales were reimbursed to the client– Many of these clients may have been self-employed, part time, house person etc. and would never have been able to claim.

Its Your Money

Income protection on the other hand is a fully advised product, generally set up by a qualified adviser. Someone who can assess a client situation and recommend whether a policy would be suitable to replace an individual’s income in the event of them being able to work through either accident or illness. In general, with income protection, you can protect up to between 60-65% of the value of your GROSS monthly pay – that’s before tax, for example is if you earn 24,000 a year you may be able to protect up to around £1300 per month. Now you can choose to have this £1300 per month, which is tax free by the way, paid until you die, reach retirement age (end of policy term) or return to work … AND you can choose to use this £1300 for whatever you want – Pay your mortgage or rent, council tax, food, bills, whatever you want… it’s YOUR money.

Deferred Period

The insurance would kick in after your employer stops paying you – This is called a deferred period – So if you get paid for 6 months the insurance starts after 6 months if you get paid for a month then it starts after a month. The longer the deferred period the cheaper the policy, if you get paid for one month but have savings that would last for and other two months then you too can consider a three-month deferred period – To manage monthly costs.

Why is this Suitable for Everyone?

So why is this suitable for everyone? Well let me make one thing clear as you get older personal insurance get more expensive regardless of whether its life cover, critical illness, or income protection. So, the younger you are the cheaper you would be all things considered equal: Let’s say you are 30 years old and on £24,000 per year and you have a qualifying illness or an accident – You could potentially be getting £1300 until state retirement age of 68 – Yes I’m afraid anyone under the age of 40 is likely to be at least 68 before state pension kicks in as things stand just now. Even without any indexation you would be close to £600,000 in total should you claim for the full term. Most people will tell you their house is their biggest asset – In most cases it’s your income that your biggest asset – Most people will earn over £1mill in their working lifetime.

The Other End of the Spectrum

The Other End of the Spectrum

Unable to Work

Let’s look at the other end of the working spectrum. Let’s say you are 57 years old and unable to work through accident or sickness, and you employer pays you for 3 months, after three months what are you going to do for income? Rely on saving?

How long would they last for? We normally recommend 3-6 months savings put away as emergency fund. Or you could access your pension? However, that’s really going to scupper all the planning you have done to retire at projected age and on the agreed level of income you need.

What if you can’t go back to work at all? What would retiring 10 years early do the value of your retirement funds, would it mean you would run out of money well before you had projected? £100,000 would maybe only last 10 or so years @ £10,000 per year, and then at 67 you survive on state pension of £9,110 a year as of today’s figures – Is that something you would be comfortable doing?

It’s for Everyone

Income protection is not only for the young, or the old, Anyone who is in receipt of an income (employed or self-employed) should consider it a priority.

Let me ask you this, what is most likely to happen to you before you retire?

- a: more likely to die?

- b: more likely to become critically or seriously ill or

- c: be off work for longer than your employer will pay you for?

Priority

Then ask yourself this – What should be the order of priority to protect? The most likely, right? If you consider that the likelihood of death is relatively low before you retire, but the impact is massive – You have life insurance for that. Critical illness more likely in fact maybe around 4 to 5 times more likely than death during your working life. impact.

Again massive, losing your income through illness or accident – Even more likely given that critical illness will likely meet the definition of a claim as well as less serious illnesses and also accidents… Impact also massive, Legal and general gave stats that the average duration of an income protection claim in the UK PRE COVID – it just shy of 5 years.

The Harsh Reality

That is the harsh reality of it – If you were lucky enough to not lose job through COVID but had income reduced to 80%, did it make a difference to you? Now the government pay £94.25 per week for statutory sick pay – £408 per month, let that sink in for a minute.

Income protection isn’t free, you need to pay for it. It’s an insurance. And as with all insurances you hope you don’t need to claim on it. The question is would you rather pay for something you might not need or have it there in case you need it?

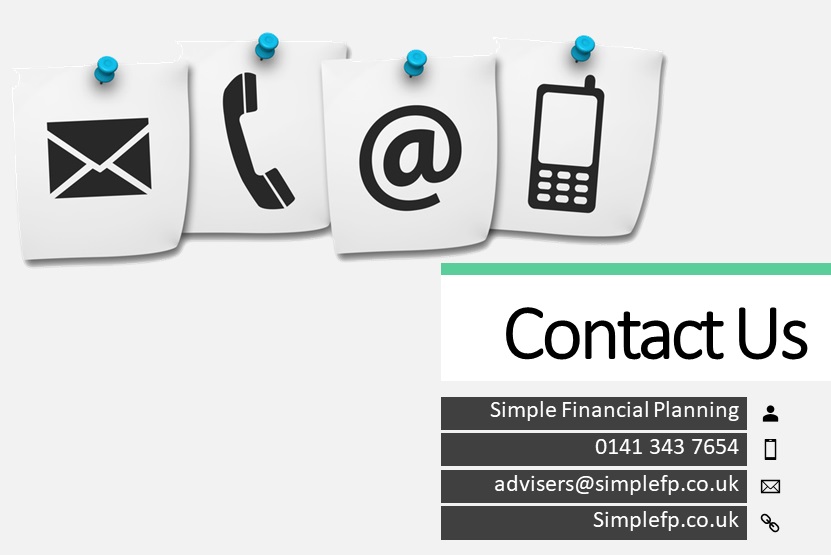

Get in touch with Simple Financial Planning

Get in touch with us today to help you with your financial needs, our aim is to make it simple for you!