A long time ago I visited a professional development seminar in which several leading UK insurers were kind enough to prepare a presentation for the people attending the event – Pretty standard stuff I hear you say, however, this was one of the occasions where I picked up something that resonated with me massively and I would like to share this with you now.. The comment was, and I’m paraphrasing here, “what’s the point in having a Porsche in your driveway if you can’t afford the petrol” BOOM!! It hit me like a ton of bricks… Let me put this in context for you by way of an example…

Let’s say Person A and B both earn £1,500 per month net, they currently have two kids aged 6 and 4 and own a property with a mortgage of £500 per month… As financially responsible individuals they have opted to have life cover to ensure that in the event of any of them dying the mortgage is paid off in full, and aside from the emotional side of the loss, the family can continue financially maintaining the same lifestyle as when both parents were still alive – Right?

Wrong… This is a common mistake that we see all the time… And this is most probably an issue with the industry as a whole rather than of the individuals taking the policies – Failing to provide enough information on the options available rather than just order taking to cover mortgage only. Now I’m not saying all advisers are doing this, I can only comment on my own findings, it’s my experience that it is not just the odd one or two.

The fact of the matter is that with mortgage protection only in the example above, the clients have a net position of minus £1,000 PER MONTH in the event of a death. And its that £1,000 that allows the lifestyle of the household – Council Tax, Food, Gas, Electricity, Clothes, Birthdays, Christmas, Holidays etc..

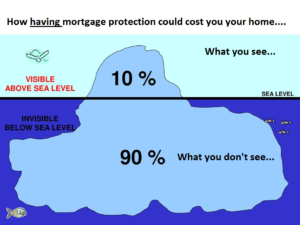

Insurance is really a fail safe to stop things from getting worse, and while mortgage protection takes care of the debt initially and is extremely Important of priority planning, it really is only the tip of the iceberg, and in order to stop things from getting worse – Ie having to sell the house because one income isn’t enough to keep you in the house even although the mortgage is paid off – There are really good and cost effect ways to protect the family lifestyle and stability beyond the loss of one income depending on the level of monthly income replacement needed on a case by case basis..

And consider this… The monthly income can also be written into trust so that should both parents die prematurely the money can then be paid to the guardian of the children, allowing the mortgage-free family home to be held as an inheritance for the kids when they grow up, while also providing a tax free income EVERY month to help the named guardian adopt to their massive change in circumstances without having to cause their own family to sacrifice due to a stretch of existing income.

If you would like to find out some more information on any of the above – Or anything else financial please feel free to reach out and contact us at [email protected] or call us 0141 343 7654.