You should always seek advice before investing with a professional, this article should not be taken as advise and is just to give you some information on the subject to help you better understand the process when talking to an adviser.

You should always seek advice before investing with a professional, this article should not be taken as advise and is just to give you some information on the subject to help you better understand the process when talking to an adviser.

Over time prices go up, this means that the value of the pound in your pocket today will be worth less next year, this is inflation.

We all experience this in our life, how many times have you said or heard ‘in my day I could have got X for that price’

Back in the 1980s the world was coming out of a period of prices going up and up which caused major problems with the economy as well as industrial issues.

This meant that rates for mortgages of 10% was common place and inflation hit the UK pretty hard.

As we moved beyond this point interest started to get lower and lower, there has been the occasional thought of rises in inflation retuning but nothing substantial.

Until now that is.

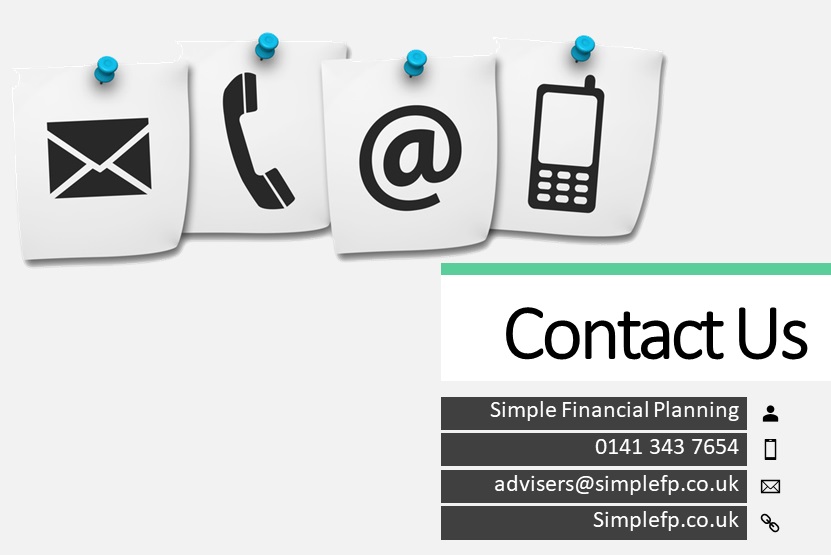

As already noted this isn’t advise and shouldn’t be treaded like it is, if you want advise then contact us at Simple Financial Planning

As already noted this isn’t advise and shouldn’t be treaded like it is, if you want advise then contact us at Simple Financial Planning

Where can inflation come from?

In the last few decades inflation has been kept low due to the increase in the digital economy and the world getting smaller with a more global community.

Since that start of the pandemic the world has seen a seismic shift from the course it was on before anyone had even heard of the word furlough and COVID was something happening somewhere else in the world that didn’t affect us.

Some of the non-medical effects of COVID are one of the largest drops in a century and unemployment creeping up and a threat to a lot of people.

Who could have imagined a government effectively shutting the country down and hoping to ride out for a few months before turning everything back on again?

Unlike prior recessions governments took the unheard-of step of implementing job retention schemes and loans for businesses to keep them going during the shut downs.

This led to households actually saving money during the lockdowns and increasing their cash reserves. It is reported that in 2020 UK households repaid £16bn in credit card and loans, the highest in recorded history.

Many companies have also rained back their investment and spend to shore up their business which means they can’t increase their output as fast as demand.

Governments all round the world are also pushing forward with their reopening with stimulus packages and incentives to get things moving again.

This all leads to the possibility of higher inflation.

The markets can feel that inflation may start rising, this has meant that bonds had a rough start this year and stock markets have fallen in the UK and the US.

What does inflation mean for investors?

Most people think £1 is and will always be work £1, unfortunately this isn’t actually true, yes that £1 will still be £1 but if you after a year what you can buy with that £1 will have decreased. Good investors understand this, if inflation has an average of 3% above the level of interest earned this means that the spending power of that £1 will actually have decreased by a quarter.

If you then scale that up to £100,000 then £25,000 is wiped out of that £100,000 after a year.

This same can also happen with Bonds and even Gold although Gold is based on a supply and demand system which means it has more room to play with.

One route to beating inflation is in Share, they can pay dividends as part of their process and like Gold the share prices are set by supply and demand.

However it is always worth remembering that investment and by extension any income that you get from them rise and fall in value. This means that you can get more back than you invested but you can also get less.

Just because something worked in the past doesn’t mean it will in the future, that’s why professional Financial Planners and advisers are constantly looking at the market and watching what is happening to keep ahead of the curve.

4 tips for picking shares to help beat inflation

Stick With What’s Secure

As inflation starts to rise as will interest rates, they go hand in hand. The secure companies, those without large debts are less likely to run into issues.

The old adage – Cash is King

The companies that can generate cash, not just profit are the companies most likely to succeed, When inflation rises the economy feels it, this creates pressure for everyone when they try to adapt. Their cash reserves are what will keep them on the right path.

Control Over Pricing

Inflation affects everyone, and this means suppliers need to increase their prices and end up passing this on to their clients. The companies that are able to control these costs are the ones that will weather the storms.

Loyalty

Keeping a loyal customer base is key to any business but those that can create that brand loyalty will be able to adjust their pricing as needed as costs rise as their customers believe in their product and will be willing to go with the increase (within reason of course)

It isn’t for everyone

If investors can build a portfolio by picking companies using these rules, there’s a chance that over time it could cope with the impact of inflationary shocks in the economy. But it’s worth remembering there are no guarantees that the stock market will keep up with inflation.

I’ve always felt that the best way to invest is to back the strongest for the longest. Resilient businesses cope with whatever the economy throws their way, and can even emerge stronger from a downturn because weaker rivals failed along the way.

These tips can be used by investors to guide them to pick the best companies, it will allow them to put your investment in the best place to weather the storms and cope with financial shocks within the economy.

It will not always work out they way you or they thought as there are no guarantees with the stock market but the professional advisers at Simple Financial Planning will always put the clients first and do what is best for them, after all its right there in the tips, Loyalty.

Get in touch with Simple Financial Planning

Get in touch with us today to help you with your financial needs, our aim is to make it simple for you!